Our comprehensive financial planning services include all areas identified and agreed to on your Financial Planning Agreement, and you are not restricted by the number of hours needed to address your planning.

Many of our plans include:

Your plan to accumulate and grow wealth can benefit from a regular review process to ensure you’re getting the most out of your strategies.

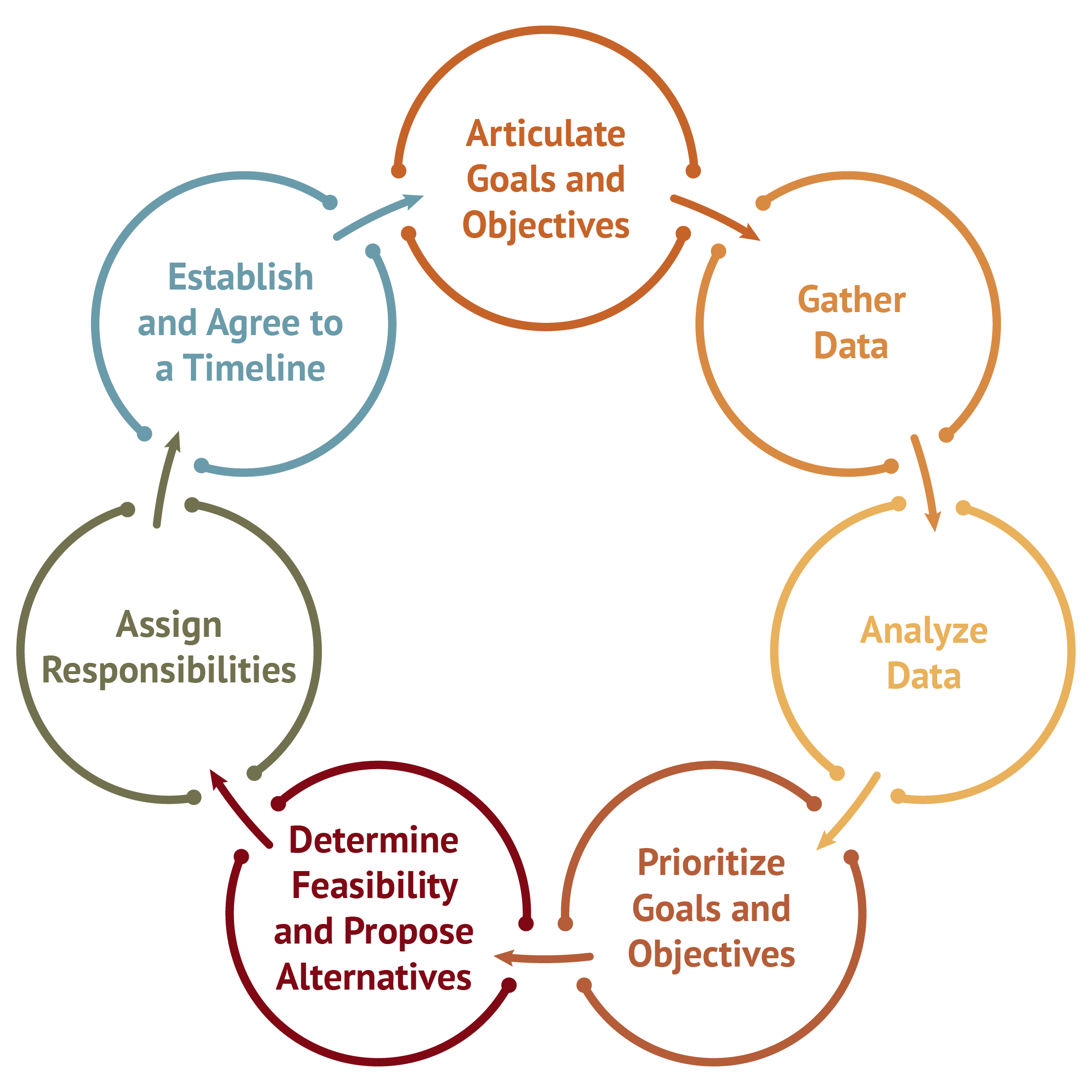

We address each area of our financial planning engagement on a continual basis using this review and assessment process:

The Circle of Action, Observation, and Measurement